I gave this article that title on submitting it, on May 5, 2020 – 20 days before the police killing of George Floyd in Minneapolis, and the subsequent steps to both revolution and violent crackdown. I can no longer say something that light, but I can say that current circumstances make it all the more painfully obvious that the end of this globalized racial capitalist world is long past due. And that deserves its own treatise, which will not be found here today.

I first left this article needing one big last rework when the COVID pandemic became visible in my part of the world [USA]. Feeling it had been made obsolete along with the rest of the old world, I moved on and into using what I’ve learned, and more importantly connecting with who I’ve met, in the world of cooperative economics, in order to take this moment to transform the world into what we’ve been dreaming all along.

In my article I wrote about the many people, including lots I failed to name — especially women, and indigenous people, and immigrant communities, and “poor” families, and squats, and tent communities, and black communities, and indigenous land rights organizers, and on and on — who have been enacting the “new” economy all along, at their peril, invisiblized and subjugated by the form of patriarchal extractive exploitative capitalism most of us mistakenly refer to as “the economy.”

I refer to many “failed” experiments in complementary currencies, and many efforts that continue to ebb and flow, like our own timebank here in Madison Wisconsin, and ones that turn into plain old relationships where people help each other out, and ones that get eaten by the non-profit industrial complex. I finally came to the conclusion that the efforts that embrace what’s known as “emergent strategy” – working with their communities, expressly building relationships and tapping into group process and collective intelligence, honoring the wisdom of each participant, aiming for diversity of perspectives, adopting clearly communicated values systems, explicitly aiming to redress wrongs and create solutions that work for everyone – are the ones that continue to live and thrive.

And now, these are some of the ones springing into action to support people in time of COVID-19. Some are providing infrastructure and guidance for new mutual aid networks, some are able to tap into membership where ready networks of people already know how to help each other out in an organized way. All the nutrients of all the various projects in different stages of birth, life, death, decomposition, are beginning to come together now to create systems that can relieve some of the suffering from the crisis, then help mitigate the damage, carry out transformative work, and usher in a lasting economic transformation.

And then, before the final edits were made, the world completely changed again with the 5/25 police killing of George Floyd. All showing even more starkly the dynamics covered here, and opening of new possibilities — beautiful as well as horrific— that were virtually unfathomable before.

Like the solutionary work I refer to below, it is all emergent, and you’re invited to participate.

But first, here is what I wrote back in February 2020…

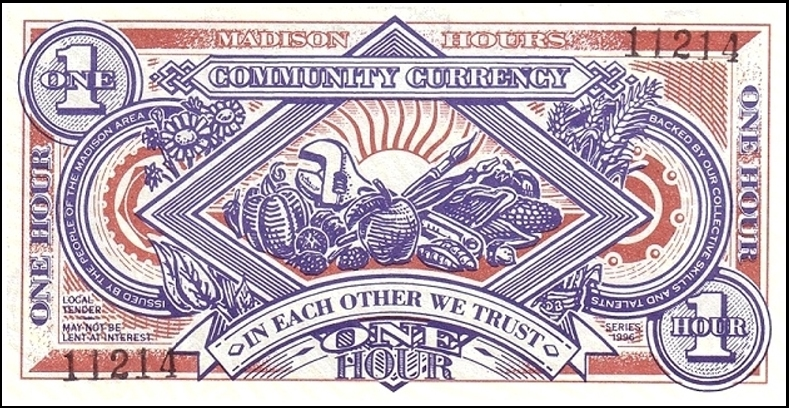

Sometime in 1995 my spouse and I, then two 20-something spanking new owners of a little neighborhood coffeehouse, stumbled on a tiny magazine piece on the Ithaca HOURs currency. We were floored by this great idea that you could create your own local money. Amazing, and so clearly needed! We joined up with a local group to make and launch our own local currency, Madison HOURs, to a lot of excitement and fanfare.

Then we spent 20 years dragging the thing behind us like a dead elephant — finally, joyfully laying it to rest with much relief in 2012.

That was my introduction to the world of complementary currency, a world in which I’ve continued to operate precisely because I don’t want people to make the same mistake we did.

That mistake was in starting with an answer to a question nobody was asking.

With all its tremendous flaws, the dominant capitalist economy IS built for business, even when it’s disadvantaging locals through its economies of scale. The market economy has not been crying out for an additional way to accept payment, especially not one that requires an extra drawer in your till, extra training for your staff, and fewer ways to spend it.

What our world IS crying out for is ways to encourage, value, and reward care. For ways to make sure our vulnerable and sick neighbors get what they need, ways to facilitate equitable distribution of resources among people especially including those who have been shut out of today’s dominant economy (black, brown, old, young, immigrant, differently abled, neuro-atypical, ‘unattractive’, lots of women, lots of men, lots of LGBTQ folks, the list goes on…). Our world is crying out for an economy that doesn’t create a fake battle of ‘jobs v. environment’ battle, an economy not built on slavery, stolen land, and a prison industrial complex. We need an economy that doesn’t steal people’s time and life energy in exchange for very basic access to very basic needs (still hard to obtain for many in the US even at full- or more than full-time employment). Our world is crying out for an economy that’s not built on eating and excreting said world.

A local currency provides a friendlier way to do business and is an excellent learning opportunity – but it does not provide the regenerative economy the world needs. However, principles of it can be a key player in the ecosystem that DOES provide that economy.

That’s the understanding that underlies my current work with Mutual Aid Networks, and the global cooperative network we’ve formed, HUMANs (Humans United in Mutual Aid Networks).

My work in mutual aid began in earnest about 10 years into the Madison HOURs experiment, when I read Bernard Lietaer’s “The Future of Money”. I was completely convinced by his description of a robust currency ecosystem, where different forms of currency are used to facilitate different types of exchange.

The perspective I gained from that book drove me to start the Dane County TimeBank, a mutual credit exchange where members exchange time instead of money, where everyone’s time is valued equally and no monetary value is attached to time. This showed me how elegant, powerful, and transformational – both on an individual and a community level – this form of equal exchange and mutuality could be.

I also saw that, like nearly every other community effort, in order to do timebanking we had to begin to play the non-profit game: applying for and reporting on funding from foundations and government sources, being dependent on their requirements, largesse, and shifts in direction. Plus, while timebanking is excellent for rewarding those infinitely abundant things like care, creativity, civic engagement, and community building, it is NOT built for business and shouldn’t mingle too much in that domain.

That’s why we started looking at how other solidarity economy tools fit into the picture, and developed our vision of the different ways of exchanging that fit together like a food chain in natural ecosystems. We realized that with a comprehensive approach to sharing, exchange, and ownership, we could much more meaningfully and systemically change how we approach work and compensation, and could more effectively change the economy by changing our own work lives and the work lives of people in our networks. We realized that, in combination, the various means of sharing and exchange already available to us could meet our needs pretty well.

To explore these ideas and also to build solidarity, the Mutual Aid Networks team (a rotating cast of collaborators since 2009) have been traveling around the US, parts of Canada, Europe and New Zealand, meeting people in person and learning about projects.

Especially in the US, but everywhere, we’ve found timebanks, local currencies, transition towns, and eco-villages that are struggling with scarcity and competition, working hard to facilitate sometimes vanishingly small amounts of participation, and burning out.

We know it’s time to put Mutual Aid tools to work for us, all who are struggling to show the world that they work, laboring away in our ‘free time’ while we work day jobs in the exploitation economy. Or working for free while the exploitation economy eats our future security (like savings or equity or familial goodwill).

In fact, a major theme throughout my solidarity economy work has been the sheer number of strong leaders and project stewards – by far a majority women – who are leading their respective projects without monetary compensation, or with sporadic and insufficient monetary compensation, or with giant strings attached to their funding.

At the same time there is the dawning of our collective consciousness that we already have what we need, have always had it, and it’s the invisibilization of that awareness that is the crux of the problem. And that we’re at the heart of the problem by defining our success and ourselves in the old capitalist paradigm, by capitalist measures. We complementary currency activists say we know these models can provide a solution, yet most of us use them marginally at best. We say we have what we need yet we don’t employ these tools to support our own efforts. Instead, you’ll find many complementary currency activists mired in endless funding pitches, competing with one another to be turned down for yet another big grant.

The complementary currencies in the US and elsewhere, almost to a one, are moribund to varying degrees – higher profile systems like Bay Bucks CA and Hudson Valley Current in NY make lovely public cases for local economies, while vanishingly small numbers engage in their exchange. From my vantage point, this is a reflection of my previous case that business already has plenty of exchange mechanisms at its disposal and the convenience costs don’t outweigh the benefits of another currency in their tills. Timebanks are faring somewhat better but tend to have very few exchanges recorded. This is also true for my own “very functional” timebank which has almost 3000 members signed up, of whom just about 100 record exchanges in any given year.

However, there is a magic in the timebank, and Madison HOURs before it, and every other limping or defunct cooperative economy experiment: it’s the dawning awareness that the economy is US, what we offer, what we share, what we receive, and that we’re free to enact it however we want. And once we have relationships with one another, and knowledge of each other’s gifts, we tend to choose to share and exchange with minimal paperwork and maximal joy.

We’re right that money is the problem. But at its heart, the problem is the central role that money has taken in human society, sucking in the rest of life like a black hole. So the solution must rest in removing it from that central space, and filling in the social vacuum around it.

When we start from that place, we make smarter choices about what economic tools to use and when. For example, we start using the formal timebank just to invite new community members and to find and build new services, but not to log transactions among people we’ve come to know. Many timebanks have begun to offer shared savings (of regular old bank money) once the need becomes apparent (LA’s Arroyo Seco Timebank is a great example), and those start with a community who already know one another and how to cooperate. And many timebanks morph into cooperative enterprise-generating organizations (e.g. in Lake County CA, or the Nuria Social in Catalonia) when the need becomes apparent and the community has built their organizing skills.

The local business-oriented complementary currency project “rCredits” morphed into a much simpler yet more powerful model, Common Good, that skips over the creation of a new currency, and combines cooperative saving-giving-lending, and a debit card. The complementary currency just wasn’t needed.

The common thread I’m witnessing is that people and projects who embrace (or at least roll with) change, unpredictability, fallow times, and emergent strategies are the ones who are flourishing.

When we recognize that defunct or barely-there currency and community projects aren’t “failures” after all, but nutrients for a more verdant garden, the picture shifts. Besides the examples in the previous paragraphs, we can point to many of our own partners who have recently obtained their own public spaces where ongoing in-person organizing, building, and emergent strategies can flourish – including our Mutual Aid pilot in Hull UK, our partners in BC-area Working Group on Indigenous Food Sovereignty, friends at STIR Magazine UK, and my own local Madison Mutual Aid Network and Dane County TimeBank. In addition, peer-to-peer support and learning opportunities are abounding:- Commons Transition, Shareable, People’s Hub, our own HUMANs network — and actively connecting formerly disconnected approaches and communities. We’re about to witness a whole new level of effectiveness, complexity, and, even more importantly, social justice and equity in our cooperative economic ecosystem.

At Mutual Aid Networks we’ve always had the ‘pave the cowpath’ philosophy – in other words, invite people to experiment freely, then document the commonly successful modalities and make them more replicable. You are invited.

Now that COVID has so clearly shown the world that the highways and byways of globalized capitalism lead us off the edge of a cliff, we can go fast in the other direction – toward creating enjoyable new livelihoods that provide clean food, water, and air, care, comfort, joy, security, and beauty. For everyone.

While we have the world’s attention, let’s show that mutual aid not only gets us through our crisis with less pain, it gets us a whole, healthy, beautiful world on the other side of it.

You can join us by offering and requesting stuff in the HUMANs global cooperative network, participate in one of our newly-hatching Common Funds, start or join projects within our collective framework, and start enjoying life as a lively human. All you need to get started can be found at mutualaidnetwork.org